Key market trends

The physical greeting cards market is large and resilient, valued at £2.0bn across the UK, Ireland and the Netherlands in 2023. It continues to grow steadily, driven primarily by increases in average selling price. The UK market rose from £1.32bn in 2021 to £1.42bn in 2023, with a small volume decline averaging 0.9% per annum.

Similarly, the Netherlands market grew from £0.29bn to £0.31bn over the same period, following the same growth patterns as the UK market.

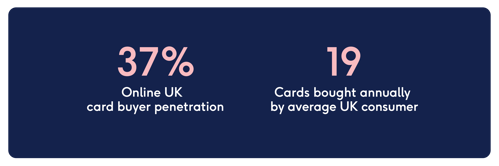

It is also a broad market, with 42m adult card buyers in the UK each purchasing an average of 19 single greeting cards per year, or 810m in total. In the Netherlands, there are 9m adult card buyers, who purchase on average 13 single cards per year, or 120m in total.

Card buying is consistent across adult age groups. For instance, in 2023 the average number of cards purchased per UK card buyer was 18.5 for 18–34 year olds, 18.5 for 35–54 year olds and 19.7 for the 55+ age group.

The physical greeting cards market remains under-penetrated online. In 2023, only 15% of total UK market value and 6% of volume was transacted online. Although 37% of UK adults bought at least one card online, most of their purchases remain offline.

Online penetration continues to rise steadily – in the UK from 10% in 2019 to 15% in 2023 and in the Netherlands from 13% to 20%.

This shift is supported by demographic trends. In 2023, online buyer penetration was 50% among 18–34 year olds, compared to 44% for 35–54 age group and 28% for those aged 55 and over.

Consumer research indicates that all age groups expect to buy more cards online in future, with younger adults showing the highest anticipated growth.

The greeting card market is fundamentally different to general e-commerce because it requires an understanding of a customer’s unique relationships, including the identity of the recipient, the gifting intent and the date of the occasion.

Card giving relates primarily to repeating annual occasions. In the UK, almost nine-tenths of card sales relate to annual occasions such as birthdays, anniversaries and key seasonal events, including Christmas, Mother’s Day, Father’s Day and Valentine’s Day.

These repeat annual occasions create a stable foundation for customer retention and long-term revenue growth. Our database of occasion reminders set means that we understand when our customers have moments of high gifting intent and can provide curated, personalised recommendations for their card and gift.

Online greeting card volume has two structural growth drivers: expanding the number of online buyers and capturing a greater share of their total card purchases.

Buyer penetration remains relatively low, with just 37% of UK buyers of physical greeting cards purchasing online. This represents a meaningful growth opportunity. We are driving the market shift to online through a proposition that we believe is superior to offline alternatives for both convenience and personalisation.

This includes our expanding range of technology-led card creative features.

In parallel, we see a substantial opportunity to deepen engagement with our customer base and increase share of wallet. While the average UK card-buying consumer buys 19 cards annually, those who already purchase online do so for only 3 of those occasions, on average. We are focused on driving purchase frequency through our platform such as occasion reminders, our Plus subscription programmes and our mobile apps.

The total addressable market (TAM) for gifting across the UK, Netherlands and Ireland is estimated at £58bn, comprising £2bn in cards, £22bn in card-attached gifting and £34bn of standalone gifting. It includes an estimated £6.5bn of gift experiences.

Our card-first strategy provides Moonpig and Greetz with profitable access to the gifting market, as we can leverage data collected during the card personalisation journey to make relevant gifting recommendations to our customers. We do this with nil incremental marketing costs, sidestepping expensive online competition for gifts and flowers, which supports high operating profit margins.

The UK gift experience market is valued at £6.5bn and presents a significant long-term growth opportunity. The gifting aggregator segment, in which we operate through our Buyagift and Red Letter Days brands, currently represents only around 5% or £270m of the total market.

Historically, the gift experience category has grown at a faster pace than the broader gifting market, reflecting secular consumer shift from physical towards experiential gifting.

Trading conditions have been challenging over the last two years and gift experiences have been shown to be more cyclical than other markets in which the Group operates. Nonetheless, we believe that once current macroeconomic pressures ease, the underlying trajectory of the experiential gifting market will reassert itself.